Table Of Contents:

- Introduction to the Lucky Reversal MT4 Indicator:

Exploring the Lucky Reversal Indicator:

Functionality and Working of the Lucky Reversal Indicator:

Key Features of the Lucky Reversal Indicator:

Recommendations for Utilizing the Lucky Reversal Indicator:

Lucky Reversal MT4 Indicator Installation:

How To Setup Lucky Reversal MT4 Indicator?

Using the Lucky Reversal Indicator for Trading:

Trading Guidelines with the Lucky Reversal Indicator:

Advantages of the Lucky Reversal Indicator:

Disadvantages of the Lucky Reversal Indicator:

Leveraging the Lucky Reversal MT4 Indicator - Recommendations & Conclusion:

Lucky Reversal MT4 Indicator Free Download:

Introduction to the Lucky Reversal MT4 Indicator:

Understanding the Need for Technical Analysis Tools: In the vast landscape of financial markets, successful trading hinges on the ability to decipher market movements effectively. Technical analysis tools stand as a crucial pillar, aiding traders in understanding and predicting market behavior. Among these tools, the Lucky Reversal MT4 Indicator emerges as a specialized instrument, finely tuned to identify trend reversals in both forex and stock markets.

While market analysis can be multifaceted and complex, the Lucky Reversal MT4 Indicator simplifies this process by amalgamating various indicators into a user-friendly interface. Its design revolves around leveraging historical price action, support and resistance levels, and specific signal patterns to pinpoint potential trend reversals. This indicator functions as a dynamic aid, enabling traders to recognize pivotal turning points in the market, thereby facilitating timely and informed trading decisions.

Beyond its technical intricacies, the significance of this indicator lies in its applicability across multiple financial instruments and time frames. Whether a trader focuses on forex pairs or diverse stocks, the adaptability of the Lucky Reversal MT4 Indicator allows for a broad spectrum of usage. Moreover, its compatibility with different time frames, particularly higher ones like H4 or D1, ensures more reliable signals and minimizes noise, enhancing its utility for traders seeking precision in their analyses.

The Lucky Reversal MT4 Indicator serves as a gateway to decoding market dynamics, offering traders a compass to navigate the intricate patterns of trend reversals. With its user-friendly interface and robust functionalities, it aims to empower traders by providing valuable insights into potential market shifts, fostering a more informed and confident trading experience.

Exploring the Lucky Reversal Indicator:

Overview of the Lucky Reversal Indicator’s Functionality:

This indicator operates as a dynamic system that automatically scans historical market data, identifying pivotal swing highs and lows: the crucial junctures signifying potential reversals in market trends. Leveraging these identified swing points, the indicator crafts dynamic horizontal lines, forming support and resistance zones that adapt and evolve in real-time with the market's changing conditions.

However, the hallmark of the Lucky Reversal MT4 Indicator lies in its ability to generate insightful arrow signals: a color-coded system distinguishing between bullish (blue) and bearish (red) reversals. These arrows appear on the chart only after a confirmation by a candlestick close, ensuring reliability and accuracy in signaling trend reversals. Additionally, it features a white square feature, acting as an alert system for potential, yet unconfirmed, reversals, urging traders to exercise caution and await further confirmation before making trading decisions.

Click on the image to open the full size version!

Compatibility and Platform Integration:

A key advantage of the Lucky Reversal MT4 Indicator is its seamless integration within the MetaTrader 4 (MT4) platform, a popular and versatile platform among traders globally. Its compatibility extends across various currency pairs and stock symbols, making it a versatile tool for traders across different financial markets.

Moreover, this indicator's compatibility with multiple time frames ensures flexibility and precision in trading strategies. While it can be applied to any time frame, its performance is notably enhanced on higher time frames, such as H4 or D1, where signals are clearer and less susceptible to market noise.

The Lucky Reversal MT4 Indicator's compatibility and adaptability underscore its efficacy, making it a sought-after tool for traders seeking reliable trend reversal insights within the dynamic landscapes of forex and stock markets.

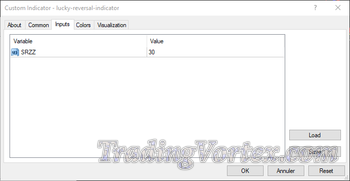

Lucky Reversal MT4 Indicator Input Settings:

The SRZZ parameter in the Lucky Reversal Indicator serves as a sensitivity control for signal frequency. Adjusting this value impacts the frequency of trend reversal signals generated by the indicator.

Click on the image to open the full size version!

- A lower SRZZ setting, below the default value of 30, heightens the indicator's responsiveness to market fluctuations. Consequently, it tends to produce more frequent signals, capturing potential reversals or shifts in trends more swiftly. Traders utilizing lower SRZZ values may experience a higher frequency of signals, which can offer more trade opportunities but may also increase the likelihood of false or premature signals, especially in volatile market conditions.

- Conversely, setting the SRZZ value higher than the default 30 reduces the frequency of signals. This higher setting makes the indicator less sensitive to minor price fluctuations, resulting in fewer but potentially more reliable signals. Traders opting for higher SRZZ values might encounter fewer signals, offering a more filtered and selective approach to trade entries, potentially reducing false signals but potentially missing some rapid market movements.

Ultimately, the choice of SRZZ value depends on a trader's preference for signal frequency, risk tolerance, and trading strategy. Lower values offer more signals but may necessitate careful filtering, while higher values reduce signals, prioritizing selectivity and potentially missing some rapid market changes. It's crucial for traders to test different SRZZ settings to align with their trading style and risk management approach.

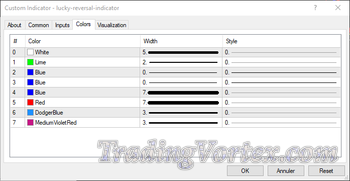

Lucky Reversal MT4 Indicator Color and Size Settings:

The specific customization options available in this tab can vary depending on the indicator's design and the developer's settings. For the Lucky Reversal Indicator, here's a general overview of how the "Colors" tab might function:

Click on the image to open the full size version!

In MetaTrader 4, the "Colors" tab within the Lucky Reversal Indicator properties offers customization for its graphical elements:

- Dynamic Support and Resistance Zones (Rows number 6 and 7): Users may adjust the colors and sizes of the support and resistance zones drawn by the indicator. This feature enables traders to personalize these critical levels on the chart.

- Arrow Signals (Rows number 4 and 5): The tab allows customization of the colors and sizes for arrow signals indicating trend reversals. Traders can typically modify colors for bullish (commonly blue) and bearish (usually red) arrows to suit their visual preferences.

- White Square Indicator (Row number 1): For the white square indicator that signifies potential reversals or shifts in momentum, traders have the option to adjust its color or size, enhancing its visibility against the chart background.

Functionality and Working of the Lucky Reversal Indicator:

Lucky Reversal Indicator Components and Mechanisms at Play:

The essence of the Lucky Reversal MT4 Indicator lies in its multifaceted components, all meticulously calibrated to decode market dynamics. At its core, this indicator operates through a sophisticated interplay of several crucial elements, orchestrating a comprehensive analysis of price movements and trend reversals.

Dynamic Support and Resistance Zones:

A pivotal feature of this indicator is the creation of dynamic support and resistance zones based on identified swing highs and lows. These zones act as crucial markers, reflecting the ebb and flow of market momentum. Continuously updating to mirror evolving market conditions, they serve as pivotal guides for traders, highlighting potential entry and exit points.

Arrow Signals for Trend Reversals:

The indicator's prowess lies in its ability to generate arrow signals: a visual representation of trend reversals. These arrows, color-coded for clarity (blue for bullish and red for bearish), serve as actionable indicators only after a confirmed candlestick closure. This confirmation mechanism ensures the reliability of signals, aiding traders in making informed decisions.

Identifying Reversals: Price Action & Support/Resistance.

Leveraging Price Action:

The Lucky Reversal MT4 Indicator operates by discerning and interpreting price action: a critical element in understanding market sentiment. Through careful analysis of historical price movements and patterns, the indicator identifies potential turning points, crucial in predicting trend reversals.

Utilizing Support and Resistance Levels:

An integral part of this indicator's methodology involves strategically leveraging support and resistance levels. By recognizing these key levels where price tends to react, the indicator identifies zones of potential trend shifts. This mechanism enables traders to anticipate market movements and adjust their strategies accordingly.

By intricately weaving together these components and mechanisms, the Lucky Reversal MT4 Indicator presents traders with a comprehensive toolset for decoding market movements. Its ability to synthesize price action and support/resistance analysis facilitates a clearer understanding of potential trend reversals, empowering traders to make well-informed trading decisions.

Key Features of the Lucky Reversal Indicator:

Dynamic Support and Resistance Zones:

A standout attribute of the Lucky Reversal MT4 Indicator lies in its establishment of dynamic support and resistance zones. These zones, derived from identified swing highs and lows, offer traders pivotal reference points within the market's ebbs and flows. Continuously adapting to real-time market conditions, these zones act as beacons, aiding traders in discerning potential trend reversals and charting strategic entry and exit points.

Arrow Signals and Their Significance:

An invaluable facet of this indicator is its utilization of arrow signals as a beacon for trend reversals. These arrow signals, characterized by distinct colors: "blue for bullish reversals and red for bearish reversals", serve as actionable indicators following confirmed candlestick closures. This confirmation mechanism ensures reliability, allowing traders to act upon well-validated signals and make informed trading decisions.

White Square Indicator: Temporary Reversal Alerts.

Complementing the arrow signals is the white square feature, serving as an alert system for potential, albeit unconfirmed, reversals. This feature acts as a cautionary signal, alerting traders to potential shifts in market momentum. While it serves as a preliminary warning, traders are advised to await further confirmation before basing trading decisions solely on this indicator, ensuring a prudent and cautious approach to market analysis.

The amalgamation of these features within the Lucky Reversal MT4 Indicator presents traders with a robust toolkit. From dynamic support/resistance zones offering strategic guidance to the clarity of arrow signals and the preemptive alertness of the white square indicator, this comprehensive suite equips traders with nuanced insights into potential market shifts, fostering more informed and cautious trading decisions.

Recommendations for Utilizing the Lucky Reversal Indicator:

Best Practices for Incorporating the Indicator:

To maximize the efficacy of the Lucky Reversal MT4 Indicator, adopting best practices is paramount. Here are key recommendations for integrating this indicator into your trading strategy:

- Combine with Confirmation Indicators: Enhance signal reliability by pairing the Lucky Reversal Indicator with confirmation indicators like moving averages or MACD. This validates trend reversals and minimizes false signals.

- Practice on Demo Accounts: Before live trading, extensively practice and fine-tune your strategy on demo accounts. This familiarizes you with the indicator's behavior, allowing adjustments to entry/exit strategies.

- Optimize Indicator Settings: Customize settings based on trading style and preferences. Adjust parameters such as sensitivity and time frames to align with your risk tolerance and market analysis.

Adapting to Market Conditions and Volatility:

Adapt strategies to varying market conditions and volatility levels for more effective use of the indicator:

- Sideways Markets: Exercise caution during low volatility or sideways markets as false signals might occur. Consider reducing trading frequency or adjusting strategies to minimize potential losses.

- High Volatility: Validate signals with additional confirmation indicators or patterns in highly volatile markets to mitigate risks associated with sudden price swings.

- Continuous Monitoring and Adaptation: Regularly assess the indicator's performance and adapt strategies to evolving market conditions. Continuous monitoring ensures relevance and effectiveness.

Which Currency Pairs to Trade?

Choosing the right currency pairs can significantly impact the effectiveness of the Lucky Reversal MT4 Indicator. Here's a closer look at considerations for selecting currency pairs:

- Focus on Major Pairs: Major currency pairs such as EUR/USD, GBP/USD, USD/JPY, and AUD/USD tend to offer enhanced liquidity and tighter spreads. These pairs often exhibit more predictable price movements and stable trends, providing a conducive environment for the indicator's signals.

- Consider Cross Pairs: Cross currency pairs like EUR/JPY, GBP/AUD, or AUD/NZD can offer alternative trading opportunities. While these pairs may exhibit slightly higher volatility and wider spreads compared to majors, they can present distinct trend patterns that the indicator might capture effectively.

- Avoid Exotic Pairs (At First): Exotic currency pairs involve currencies from smaller or emerging economies and often have lower liquidity and wider spreads. Traders, especially those new to using the indicator, might initially avoid these pairs due to increased volatility and erratic price movements, which may result in less reliable signals.

Adapt to Preferences and Trading Styles: Consider aligning currency pair selections with personal trading preferences and risk tolerance. Some traders may prefer specific pairs due to familiarity or unique trading strategies that suit those particular pairs.

What is the Best Trading Session for this Indicator?

Optimal trading sessions play a pivotal role in leveraging the potential of the Lucky Reversal MT4 Indicator. Considerations for choosing the most suitable trading session are crucial:

- Overlapping Sessions Yield Opportunities: Trading during sessions that overlap, particularly during the London-New York overlap (8 AM to 12 PM EST), often presents increased liquidity and heightened market activity. This period is renowned for its potential to generate stronger trends and clearer signals, aligning well with the indicator's functionality.

- Asian Session Considerations: The Asian session (Tokyo, 7 PM to 4 AM EST) might exhibit lower volatility compared to the aforementioned overlap sessions. Traders operating during this session might experience less erratic price movements, making it conducive for more cautious trading strategies when using the indicator.

- Prefer Session Alignment with Strategy: Align your choice of trading session with your trading strategy and personal schedule. Some traders might find success during specific sessions due to their familiarity with those market conditions or their preferred trading style.

Awareness of Session-Specific Volatility: Each trading session has its unique characteristics. The London-New York overlap often witnesses increased volatility, presenting both opportunities and risks. Traders must adjust their risk management and strategy to accommodate session-specific market behaviors.

What Time Frame Should You Trade?

Selecting the appropriate time frame is crucial when employing the Lucky Reversal MT4 Indicator, as it significantly impacts signal accuracy and trading strategies:

- Higher Time Frames Enhance Clarity: Trading on higher time frames, such as the 4-hour (H4) or daily (D1) charts, often provides clearer signals with reduced market noise. These time frames tend to filter out short-term fluctuations, offering a more comprehensive view of the market's trend direction.

- Precision versus Frequency: Lower time frames, like the 15-minute (M15) or 1-hour (H1) charts, might generate more frequent signals but often carry increased noise and may produce less reliable indications. Traders employing these shorter time frames might seek more precise entry and exit points, albeit with potentially higher risk.

- Adapt to Trading Style and Goals: Align the choice of time frame with your trading style and objectives. Short-term traders aiming for quick, intraday moves might prefer lower time frames, while swing or position traders seeking broader trends might favor higher time frames for more comprehensive market insights.

- Balance Risk and Reward: Consider the trade-off between signal accuracy and trading frequency. Higher time frames often offer more reliable signals but might require more patience and prolonged holding periods. Conversely, lower time frames might offer quicker trades but might also carry increased risks.

- Test and Adapt: Experiment with various time frames to identify which aligns best with your trading strategy and risk tolerance. Utilize demo accounts to test different time frames and observe how the indicator performs across each, allowing for data-driven decisions in selecting the most suitable time frame.

When Not To Follow The Signal of This Indicator?

While the Lucky Reversal MT4 Indicator serves as a valuable tool, there are scenarios where caution should be exercised, and traders may opt to refrain from solely relying on its signals:

- During High-Impact News Releases: Major economic news releases, central bank statements, or geopolitical events often introduce unpredictability and increased volatility to the market. During these periods, the indicator's signals might be less reliable due to erratic price movements caused by unexpected news, making it prudent to await market stabilization before acting upon signals.

- In Low-Liquidity Periods: Trading during periods of low liquidity, such as market closes or holiday periods, can lead to exaggerated price movements and widened spreads. The resulting erratic behavior might generate false signals or erratic price spikes, making it challenging for the indicator to provide accurate readings.

- During Market Unpredictability: Uncertain market conditions, characterized by irregular price movements or choppy, indecisive patterns, might invalidate the indicator's signals. Such market phases often lack clear trends or exhibit erratic behavior, leading to false signals or ambiguous indications.

- When Conflicting Signals Arise: If signals from the Lucky Reversal Indicator contradict strong trends established by other well-validated indicators or technical analysis tools, exercising caution is wise. Conflicting signals might indicate potential market indecision or inconclusive reversal patterns.

- Amidst Unusual Price Movements: Sudden and extreme price movements, often referred to as "flash crashes" or irregular spikes, might trigger false signals. These anomalies can disrupt the indicator's readings, potentially leading to misleading signals that do not align with regular market behavior.

- After Prolonged Market Closure: Following extended market closures, such as weekends or holidays, the initial market reopening might witness irregular price gaps or abnormal movements. During these periods, the indicator's signals might be distorted or less reliable until the market stabilizes.

How to Use the Lucky Reversal MT4 Indicator When Trading Stocks?

Utilizing the Lucky Reversal MT4 Indicator in stock trading involves similar principles to forex trading, albeit with some considerations specific to stocks:

- Identify Liquid Stocks: Focus on stocks with ample liquidity and trading volume. High-liquidity stocks are less prone to erratic price movements and offer more reliable signals, aligning well with the indicator's functionality.

- Consider Fundamental Analysis: Incorporate fundamental analysis alongside the indicator. While the indicator primarily focuses on technical aspects, combining it with fundamental analysis can provide a more comprehensive view of stock movements.

- Adjust Time Frames for Stocks: Stocks may exhibit different price behaviors compared to currency pairs. Experiment with various time frames, possibly leaning towards shorter time frames for stocks, as they might respond differently to the indicator's signals compared to forex markets.

- Account for Market Hours: Trading stocks within regular market hours allows for increased liquidity and better alignment with traditional trading patterns. Be mindful of pre-market and after-market sessions, which may exhibit lower volume and increased volatility, potentially affecting the indicator's signals.

- Validate Signals with Stock-Specific Analysis: Consider analyzing stock-specific factors, such as company news, earnings reports, or industry trends, to validate the indicator's signals. Company-specific events can significantly impact stock prices, affecting the indicator's accuracy.

By integrating these recommendations, traders can effectively maximize the utility of the Lucky Reversal MT4 Indicator while navigating diverse market conditions with adaptability and prudence. These practices foster a more nuanced approach, enhancing the indicator's effectiveness within trading strategies.

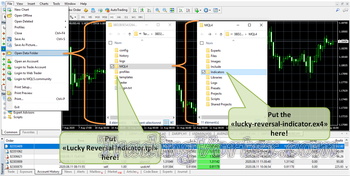

Lucky Reversal MT4 Indicator Installation:

First of all, you need to download and extract the archive “Lucky-Reversal-MT4-Indicator.zip” at the bottom of this page. It contains the “lucky-reversal-indicator.ex4” file which is the indicator itself and the “Lucky Reversal Indicator.tpl” file which is the template to quickly load the indicator on the chart using the default settings in combination with the 14 SMA and 20 SMA.

Step 1:

- Open your MT4 (MetaTrader 4) platform.

Click on “File” then “Open Data Folder”. Here you will find a folder called “MQL4”, this is the home for all “.ex4” and “.mq4” files you have.

Open the folder “MQL4”. Here you will find “Indicators” folder, where you should put the “lucky-reversal-indicator.ex4” file downloaded from our site. Do this by right clicking on the file then clicking “copy” and “paste”. - The folder called “templates” is the home for all your ".tpl" files, put “Lucky Reversal Indicator.tpl” file there.

Restart your MT4.

Click on the image to open the full size version!

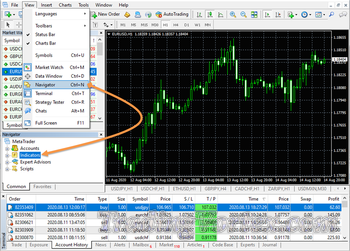

Step 2:

- Open the MT4 (MetaTrader 4) platform, and click on: "View/Navigator". You can also press CTRL+N.

- When the window titled "Navigator" will appear click on "Indicators".

- You should found “lucky-reversal-indicator” on the list.

Click on the image to open the full size version!

How To Setup Lucky Reversal MT4 Indicator?

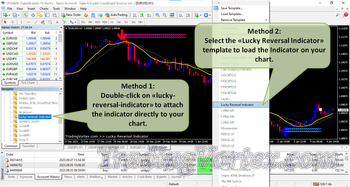

When both files: “lucky-reversal-indicator.ex4” and “Lucky Reversal Indicator.tpl” are properly installed, you can easily apply the indicator to your chart. you can do this using one of two ways:

Attach the Indicator Directly to Your Chart:

You can do this by double-clicking on “lucky-reversal-indicator” present on the list of indicators in the “Navigator” window or by dragging and dropping it on your chart.

Use this method if you want to include this indicator with another indicator or system. If you want to use it alone, it is better to launch the “Lucky Reversal Indicator.tpl” template.

Apply “Lucky Reversal Indicator.tpl” to Your Chart:

- Click on the “Templates” button to display the list of templates present on your platform: you should see “Lucky Reversal Indicator” on this list.

- Select “Lucky Reversal Indicator” template on the dropdown list.

- If the template doesn't exist, confirm its presence inside the folder called “templates” under “Open Data Folder” and restart your MT4 terminal.

Click on the image to open the full size version!

Using the Lucky Reversal Indicator for Trading:

Interpreting Arrow Signals: Buy and Sell Indications.

The Lucky Reversal MT4 Indicator's arrow signals serve as primary cues, yet incorporating them into a robust trading system with additional indicators or market structures amplifies trading precision.

- Buy Signals (Bullish Reversals): Blue arrows denote potential bullish reversals, indicating opportunities for buying or entering long positions.

- Sell Signals (Bearish Reversals): Conversely, red arrows signify potential bearish reversals, suggesting selling or entering short positions.

White Square Indicator Utility:

The White Square Indicator within the Lucky Reversal Indicator serves as an early warning system, signaling potential reversals in the market. Understanding its significance enhances trade decisions when integrated into strategies alongside the Lucky Reversal Indicator.

Interpreting the White Square Signal:

- Warning of Possible Reversals: The appearance of the white square on the chart signifies a temporary or potential reversal. It alerts traders to exercise caution and monitor price action closely.

- Temporary Momentum Shift: The white square indicates a pause in the current trend's momentum, suggesting a potential change in direction. However, it doesn't serve as a definitive signal for entry or exit; rather, it prompts traders to prepare for potential shifts.

Incorporating the White Square Signal into Strategies:

- Confirmation of Trend Reversal: Combine the white square signal with subsequent changes to uptrend or downtrend signals given by the Lucky Reversal Indicator for enhanced confirmation.

Integration with Strategy Execution:

- Using the White Square as an Early Alert: When the white square appears, it indicates caution and alerts traders to potentially changing market dynamics.

- Confirming Reversal Signals: After the appearance of the white square, observe the Lucky Reversal Indicator. When the white square changes to a buy or sell signal, confirmed by the Lucky indicator's subsequent uptrend or downtrend indication, consider entering a trade.

Application within Trading Strategies:

- Supporting Entry/Exit Decisions: While not a standalone signal, the white square can complement entry and exit decisions when used in conjunction with the Lucky Reversal Indicator.

- Enhancing Confidence in Trade Execution: Combining the white square alert with subsequent confirmations from the Lucky Reversal Indicator fortifies traders' confidence in identifying potential trend reversals.

Strategy Combining the Lucky Reversal Indicator with Moving Averages:

Leveraging the synergy between the Lucky Reversal Indicator and moving averages presents a structured methodology to identify trend confirmations and refine entry points.

Pairing the Indicators:

Two Essential Moving Averages: Employ two moving averages: "a faster and a slower one", to complement the Lucky Reversal Indicator's signals. The default moving average functions as the faster moving average, while configuring the second moving average with a 20-period setting designates it as the slower moving average.

Implementing the Strategy:

Confirmation via Trend Direction: Rely on the Lucky Reversal Indicator to identify trend directions through its arrow signals: "blue for bullish reversals and red for bearish reversals".

- Uptrend Confirmation: When the Lucky indicator confirms an uptrend (displaying a blue arrow), seek a potential buy signal. Look for a scenario where the faster moving average crosses above the slower moving average. This intersection serves as an additional confirmation for initiating a buy trade.

- Downtrend Confirmation: Conversely, upon receiving a downtrend confirmation from the Lucky indicator (red arrow), observe the faster moving average crossing below the slower moving average. This intersection substantiates a sell signal, reinforcing the downtrend indication provided by the indicator.

Enhancing Entry Precision:

Validating Entries: The combined strategy aims to validate entries by using the Lucky indicator's trend direction as a primary signal and corroborating it with the moving average crossovers. This dual confirmation enhances the precision of trade entries, reducing the likelihood of entering against the trend.

Practical Application:

This strategy ensures traders enter positions aligned with the prevailing trend indicated by the Lucky Reversal Indicator. By using the moving averages to confirm trend direction, traders can execute trades with increased confidence, minimizing the risk of false entries and capitalizing on opportunities aligned with both indicators' consensus. Testing and adapting this strategy in demo trading environments allow traders to fine-tune their approach and optimize their trading decisions.

Strategy Example: Combining Lucky Reversal Indicator with 14 SMA and 20 SMA.

Here's an example illustrating the strategy using the Lucky Reversal Indicator alongside two specific moving averages: the 14-period Simple Moving Average (SMA) as the faster MA and the 20-period SMA as the slower MA.

Setting Up the Indicators:

- Lucky Reversal Indicator: Displayed on the chart, generating arrow signals indicating potential trend reversals.

- 14 SMA (Fast MA) and 20 SMA (Slow MA): Plotted alongside the Lucky Reversal Indicator when using the "Lucky Reversal Indicator.tpl".

Click on the image to open the full size version!

You can instantly load the entire system: “the Lucky Reversal Indicator and the two specified SMAs” by selecting the "Lucky Reversal Indicator.tpl" model present in the downloaded package, as described previously in the Setup section.

Interpreting Signals:

- Uptrend Confirmation (Buy Signal): Upon receiving a blue arrow from the Lucky indicator, indicating a potential bullish reversal: Check for a confirmation where the 14 SMA (fast MA) crosses above the 20 SMA (slow MA). This crossover acts as additional confirmation for initiating a buy trade.

- Downtrend Confirmation (Sell Signal): Upon receiving a red arrow from the Lucky indicator, indicating a potential bearish reversal: Look for confirmation as the 14 SMA (fast MA) crosses below the 20 SMA (slow MA). This intersection substantiates a sell signal, reinforcing the downtrend indicated by the Lucky Reversal Indicator.

Enhancing Entry Precision:

Validating Entries: Utilizing both the Lucky Reversal Indicator's trend direction and the crossover of the 14 SMA and 20 SMA validates trade entries, minimizing the possibility of entering against the prevailing trend.

Trading Execution:

- Buy Trade Execution: When an uptrend is confirmed by the Lucky Reversal Indicator's blue arrow and the 14 SMA crosses above the 20 SMA, consider initiating a buy trade.

- Sell Trade Execution: In the presence of a downtrend indicated by the Lucky Reversal Indicator's red arrow and a crossover where the 14 SMA crosses below the 20 SMA, contemplate executing a sell trade.

Strategies for Confirming Signals and Reducing False Positives

Mitigate risks and refine signal reliability through additional confirmation techniques:

- Confirmation Tools: Integrate other technical indicators or market structures, such as support/resistance levels, candlestick or chart patterns, to validate the Lucky Reversal Indicator's signals.

- Adaptation and Experimentation: Tailor strategies by experimenting with different indicators or market structures that complement the Lucky indicator, refining your system based on observed efficacy.

By amalgamating the Lucky Reversal MT4 Indicator into a comprehensive trading system, traders can harness its signals in alignment with other indicators or strategies, bolstering trade decisions with reinforced confirmation and precision. Integrating multiple tools allows for more robust and validated trading setups.

Trading Guidelines with the Lucky Reversal Indicator:

Discover a comprehensive set of guidelines meticulously designed to streamline trade execution with the Lucky Reversal Indicator. This section offers detailed rules and step-by-step approaches for both buy and sell orders, empowering traders with a systematic strategy to effectively interpret signals, initiate trades, and make informed decisions aligned with prevailing market trends.

Trading Rules for Buy Orders with the Lucky Reversal Indicator:

Optimize your buy order executions with detailed steps specifically aligned with the Lucky Reversal Indicator's signals:

Opening Buy Trades with the Lucky Reversal Indicator:

- Confirm Bullish Trend Direction » Lucky Indicator's Blue Arrow Signal: Rely on the appearance of the blue arrow from the Lucky Reversal Indicator, signifying bullish reversals, to confirm the presence of an uptrend.

- Consider White Square Alerts » Interpreting the White Square: Acknowledge the white square as a preliminary signal indicating a potential pause or temporary reversal in the prevailing trend. Use this alert to exercise caution before entering a buy trade.

- Seek Confirmation Signals (if applicable) » Alignment with Moving Averages: If using moving averages, confirm the Lucky indicator's bullish trend with a crossover of specified moving averages (e.g., fast MA crossing above the slow MA) to strengthen the buy decision.

- Wait for Confirmation of Uptrend » Comprehensive Signal Confirmation: Enter a buy trade only after a thorough confirmation from the Lucky Reversal Indicator's blue arrow and additional indicators, ensuring a strong alignment with the established uptrend.

Closing Buy Trades with the Lucky Reversal Indicator:

- Monitor Potential Reversals » Observing Signal Changes: Keep watch for any alterations in the Lucky Reversal Indicator's signals, "specifically, shifts from the blue arrow to a red arrow or changes in the white square alert", indicating a potential shift in the prevailing trend.

- Review Exit Strategies » Assessment of Stop-loss and Take-profit: Evaluate predetermined exit strategies, including the placement of stop-loss and take-profit levels, ensuring they align with your risk tolerance and the current market conditions.

- Consider Market Dynamics » Analyzing Market Volatility: Assess overall market volatility, upcoming economic events, or significant news releases, particularly considering the impact on a buy trade's sustainability in case of contradictory signals.

- Evaluate Risk-Reward Ratio » Risk Assessment: Analyze the risk-reward ratio thoroughly, contemplating the closure of the buy trade if the perceived risk exceeds the anticipated reward or if the market indicates a possible trend reversal that may invalidate the initial buy thesis.

Buy Trade Example Using the Lucky Reversal Indicator:

The appearance of the White Square on the chart signifies a temporary or potential bullish reversal. While it serves as a preliminary warning, traders are advised to await further confirmation. It doesn't serve as a definitive signal for buy entry.

Click on the image to open the full size version!

The appearance of the Blue arrow (Buy Signal) in combination with the Dynamic Support Zone denote potential bullish reversal, indicating opportunities for buying or entering long position.

Click on the image to open the full size version!

Seek for the Moving Averages confirmation signal: 14 SMA crossing above the 20 SMA. When all conditions are met, open a buy order.

Click on the image to open the full size version!

The White Square Indicator acts as a cautionary signal, alerting traders to potential shifts in market momentum. You can use it as an early signal to close the buy position or wait for further confirmation.

Click on the image to open the full size version!

Trading Rules for Sell Orders with the Lucky Reversal Indicator:

Refine your sell order executions with a step-by-step approach aligned with the signals provided by the Lucky Reversal Indicator:

Opening Sell Trades with the Lucky Reversal Indicator:

- Confirm Bearish Trend Direction » Lucky Indicator's Red Arrow Signal: Rely on the appearance of the red arrow from the Lucky Reversal Indicator, signaling bearish reversals, to confirm the existence of a downtrend.

- Consider White Square Alerts » Interpreting the White Square: Acknowledge the white square as an early warning, indicating potential temporary reversals or loss of momentum in the ongoing trend. Exercise caution before initiating a sell trade.

- Seek Confirmation Signals (if applicable) » Alignment with Moving Averages: If utilizing moving averages, corroborate the Lucky indicator's bearish trend with a crossover of specified moving averages (e.g., fast MA crossing below the slow MA) to fortify the sell decision.

- Wait for Confirmation of Downtrend » Thorough Signal Validation: Enter a sell trade only after comprehensive confirmation from the Lucky Reversal Indicator's red arrow and additional indicators, ensuring a strong alignment with the established downtrend.

Closing Sell Trades with the Lucky Reversal Indicator:

- Monitor Potential Reversals » Observing Signal Changes: Stay vigilant for any alterations in the Lucky Reversal Indicator's signals, "specifically, shifts from the red arrow to a blue arrow or modifications in the white square alert", indicating potential shifts in the ongoing trend.

- Review Exit Strategies » Assessment of Stop-loss and Take-profit: Review predefined exit strategies, including the placement of stop-loss and take-profit levels, ensuring alignment with your risk tolerance and the present market conditions for sell trades.

- Consider Market Dynamics » Analyzing Market Volatility: Evaluate overall market volatility, imminent economic events, or significant news releases that could influence a sell trade's viability, especially in the presence of conflicting signals.

- Evaluate Risk-Reward Ratio » Risk Assessment: Analyze the risk-reward ratio thoroughly, considering the closure of the sell trade if the perceived risk outweighs the expected reward or if the market hints at a possible trend reversal contradicting the initial sell thesis.

Sell Trade Example Using the Lucky Reversal Indicator:

The appearance of the White Square on the chart signifies a temporary or potential bearish reversal. While it serves as a preliminary warning, traders are advised to await further confirmation. It doesn't serve as a definitive signal for sell entry.

Click on the image to open the full size version!

The appearance of the Red arrow (Sell Signal) in combination with the Dynamic Resistance Zone denote potential bearish reversal, indicating opportunities for selling or entering short position.

Click on the image to open the full size version!

Seek for the Moving Averages confirmation signal: 14 SMA crossing below the 20 SMA. When all conditions are met, open a sell order.

Click on the image to open the full size version!

The White Square Indicator acts as a cautionary signal, alerting traders to potential shifts in market momentum. You can use it as an early signal to close the sell position or wait for further confirmation.

Click on the image to open the full size version!

Advantages of the Lucky Reversal Indicator:

The Lucky Reversal Indicator presents a spectrum of advantages, elevating its appeal and functionality for traders seeking precise market insights:

Easy Interpretation and Application:

- Simplicity in Usage: The indicator's intuitive nature simplifies interpretation, allowing traders, regardless of experience, to swiftly comprehend and apply its signals for decision-making.

- User-Friendly Interface: Its straightforward design within the MT4 platform streamlines usage, enabling seamless integration into trading strategies without steep learning curves.

Profiting from Trend Capturing Abilities:

- Spotting Lucrative Trends: The indicator's prowess lies in identifying trend reversals with precision, empowering traders to capitalize on potentially lucrative market movements.

- Enhanced Trade Entries: Accurate signals aid in identifying optimal entry points, facilitating better trade timing and potentially increasing profit potential.

Versatility Across Instruments and Time Frames:

- Instrument Flexibility: Its adaptability extends across various financial instruments, accommodating trading across diverse markets, including forex pairs and stocks.

- Time Frame Compatibility: Effective performance across multiple time frames, particularly on higher time frames like H4 or D1, offers reliable signals, reducing noise and enhancing trading confidence.

The Lucky Reversal Indicator's advantages encompass its user-friendly nature, trend capturing abilities, and adaptability, presenting traders with a versatile tool for informed decision-making across different markets and time frames.

Disadvantages of the Lucky Reversal Indicator:

While the Lucky Reversal Indicator offers valuable insights, it also presents some limitations that traders should consider:

Lagging Signals and Missed Opportunities:

- Delayed Signal Confirmation: Being a lagging indicator, the Lucky Reversal might signal trend changes after they have initiated, resulting in delayed entry points and missed early opportunities.

- Potential Missed Entries: Due to its nature, the indicator may not capture rapid market shifts promptly, causing traders to miss some potentially profitable entry points.

False Signals in Volatile Market Conditions:

- Vulnerability to Whipsaws: During erratic market movements or high volatility periods, the indicator might generate false signals, leading to premature trades or frequent reversals.

- Sideways Market Challenges: In sideways or range-bound markets, where prices fluctuate within a confined range, the indicator may produce inaccurate signals, posing challenges for traders seeking clear trend directions.

Lack of Trend Strength Assessment:

- Limited Insight into Strength: The indicator's signals lack specific metrics assessing the strength or duration of a trend reversal, making it challenging for traders to gauge the potential longevity or intensity of the emerging trend.

- Difficulty in Exit Timing: Without comprehensive insights into trend strength, determining the ideal exit points becomes complex, potentially impacting the timing of trade closures.

Acknowledging these limitations, including lagging signals, susceptibility to false signals in volatile markets, and the absence of trend strength assessment, is crucial for traders incorporating the Lucky Reversal Indicator into their strategies. Understanding these drawbacks aids in mitigating risks and refining trade decisions.

Leveraging the Lucky Reversal MT4 Indicator - Recommendations & Conclusion:

Utilizing the Lucky Reversal MT4 Indicator demands a balanced understanding of its capabilities and limitations. Here's a comprehensive conclusion with usage recommendations:

Recap of Pros and Cons:

In review, the Lucky Reversal Indicator exhibits notable advantages, including its user-friendly nature for easy interpretation, trend capturing abilities aiding in optimal entries, and versatility across instruments and time frames. However, its disadvantages, such as potential lagging signals, susceptibility to false signals in volatile markets, and the lack of trend strength assessment, present challenges that traders should heed.

Emphasizing Risk Management and Testing:

- Risk Mitigation Strategies: Given the indicator's limitations, employing robust risk management techniques becomes paramount. Setting appropriate stop-loss levels, defining exit strategies, and sizing positions in line with risk tolerance are crucial practices to minimize potential losses.

- Demo Testing Before Live Trading: Prior to integrating the indicator into live trading, extensive testing on a demo account is highly recommended. This enables traders to grasp the indicator's nuances, refine strategies, and comprehend its behavior across various market conditions without financial risk.

By embracing the Lucky Reversal Indicator's strengths while diligently considering its limitations, traders can navigate markets more effectively. Emphasizing prudent risk management practices and thorough testing before live trading ensures a more informed and prepared approach towards harnessing the indicator's potential.

Lucky Reversal MT4 Indicator Free Download:

The download archive contains the following files:

- lucky-reversal-indicator.ex4: The Lucky Reversal MT4 Indicator itself.

Lucky Reversal Indicator.tpl: The model that will plot the Lucky Reversal MT4 Indicator with both 14 SMA and 20 SMA.

Lucky Reversal Indicator for Metatrader4 - Free Download| 33.74 Ko| 01/01/2024, 04:21

TradingVortex.com® 2019 © All Rights Reserved.

TradingVortex.com® 2019 © All Rights Reserved.